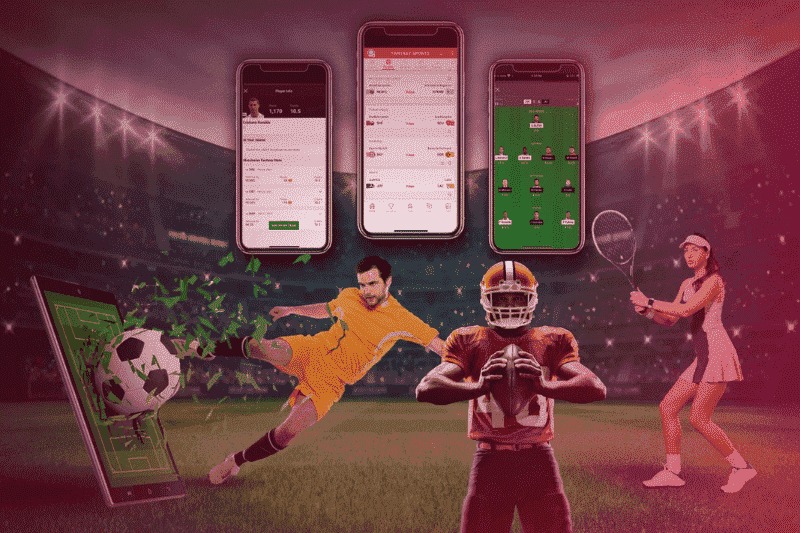

28% GST On Online Gaming Will Not Impact E-sports And Video Games

The recent decision of the Indian government to impose 28 per cent goods and services tax (GST) on online games that involve real money has created a lot of unrest. However, the new laws will not impact the taxation laws on e-sports games. The higher tax rate is only for the pay-to-win games, such as fantasy sports, rummy, and poker, which include a scope of monetary gains.

According to a government official, “E-sports and video games, intended purely for entertainment and not involving betting, gambling or any money transactions, will continue to be taxed as they have been.”

Presently, e-sports and games are meant to attract 18 per cent GST. Among the esports players, bigger companies like Microsoft and Activision Blizzard usually offer their games without any betting component.

Rules are currently being developed to separate sports or games meant only for entertainment from those for financial benefit. “The detailed framework will specify terms like ‘online money gaming’ and what all will fall under this category,” a senior official familiar with the situation said.

The GST Council in its last meeting on 2nd August decided to impose a 28 per cent tax on the total bet placed at entry level for each gaming session from October 1. According to sources, some of the main players in the video game sector addressed the finance ministry to request precise demarcation to clear up any misunderstandings caused by the phrase.

Some of these organizations expressed worries about the unrelated correlation between e-sports and gambling, betting, and associated activities in their representations to the government. Globally, there are thought to be between three and four billion players of video games and e-sports.

According to a person with knowledge of the conversation, the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules recognize e-sports and should be explained for taxation purposes.

At its most recent meeting, the GST Council decided to add the following definition of online gaming: “An offering of a game on the internet or an electronic network and includes online money gaming.”

Online gambling could refer to “games where players pay or deposit money or money’s worth, including virtual digital assets, in the expectation of winning money.”

According to Bipin Sapra, partner at EY India, “the GST law’s differentiation between online games and games for real money will allow the industry, where there are no money winnings involved, to pay tax at 18%, like any other online portal.”

Additionally, a new clause is anticipated to include online gambling for real money that is provided by a person who resides outside the taxable area. The individual will be covered by the Integrated GST.